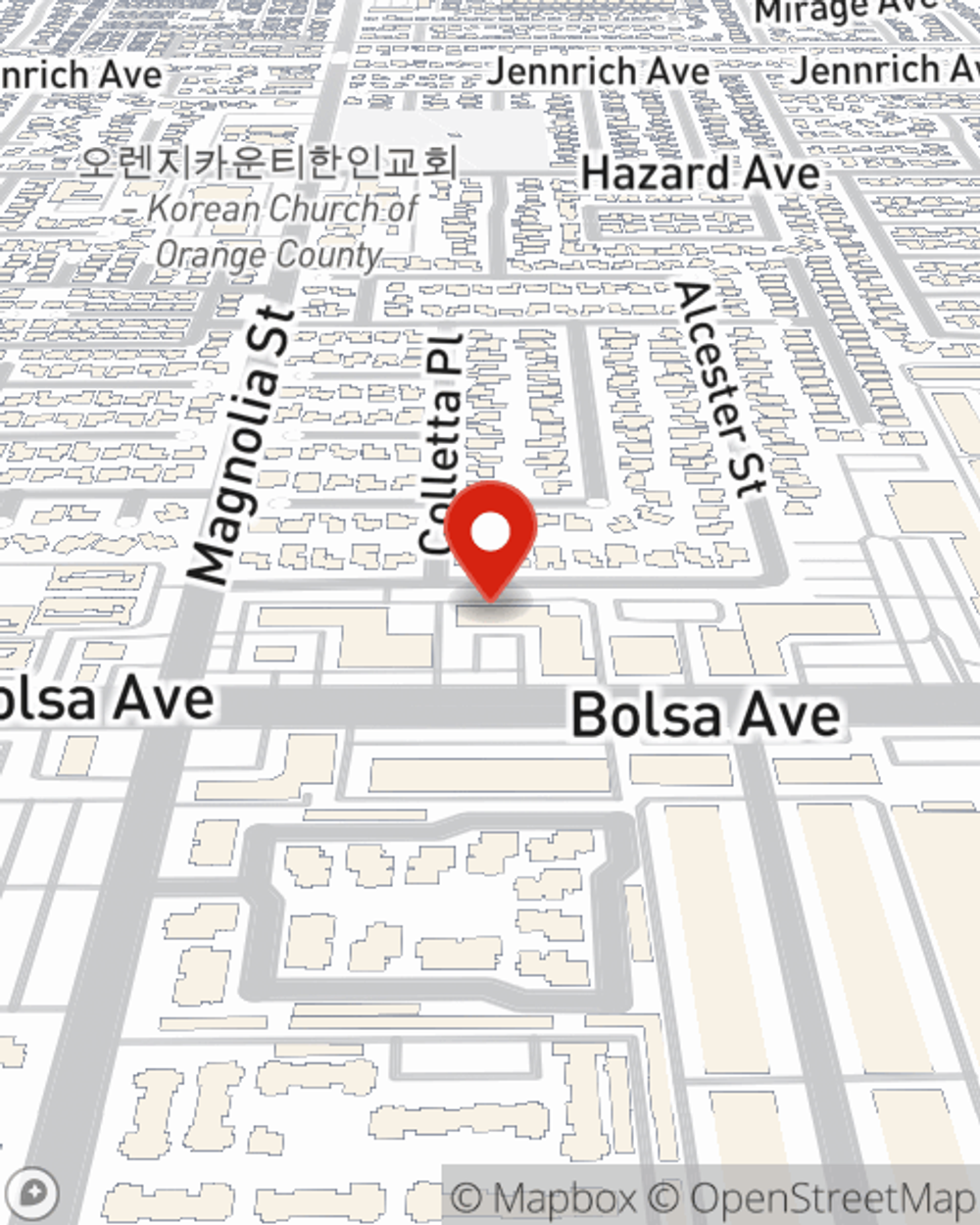

Business Insurance in and around Westminster

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to focus on. It's understandable. State Farm agent William Vu is a business owner, too. Let William Vu help you make sure that your business is properly insured. You won't regret it!

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Keep Your Business Secure

For your small business, whether it's a clock shop, a shoe store, a beauty salon, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like extra expense, equipment breakdown, and buildings you own.

Reach out to the outstanding team at agent William Vu's office to explore the options that may be right for you and your small business.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

William Vu

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.